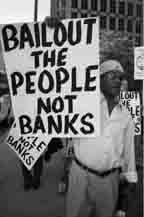

What the Corporate Bailout Means to all of us...

|

|

by Phil Adams/Race, Poverty, Media Justice Intern I know what it is to be used by the government for the profit of a few corporations. Since I have become a veteran I learned the planes I flew in were from Lockheed Martin, weapons I used were from Colt-Remington, and the computers I used and soda I drank were procured from Haliburton. I have learned that the blood shed in Iraq was for the purpose of buying items from these corporations. At this point I believe that private corporations play more of a part in decision making within the government than the citizens do. With this corporate bail out I believe our country has transferred public finances to private hands and private debt onto the public. It was around Ten o'clock in the morning when I showed up at the Mortgage Bankers Association's annual conference. I walked into Moscone Center and immediately felt out of place. The hall was empty with high white ceilings and empty booths. Bland colored banners with lame catch phrases and stock photos urging me to invest in real estate, obviously designed by a drowsy office worker somewhere only to be tossed into the dumpster the next day. I knew I stood out, the only people in the room were pale fat sixty year olds with saggy faces and business suits, six uniformed police officers, the hazy eyed brow beaten convention staff and me, a twenty something year old from Richmond in a leather jacket. Eventually one gray-haired convention staffer mustered up enough courage to ask me if I needed assistance. I saw him eyeing me through his thin-rimmed glasses. I took a breath and looked at him for a second knowing he was making minimum wage and probably coming on retirement age, the placard on his chest reading event staff made me want to ask him the same question. I told him I was interested in learning about the Mortgage Bankers Association. I must have touched some type of robotic knee jerk reaction for his occupation because he pointed me to the information desk and went back to standing at the door with his walkie-talkie. At this point I knew I wasn't going to get anywhere and I knew I was about to be asked to leave. About an hour later the protest started. It was organized by A.N.S.W.E.R. SF. The reason I was there was to find information and do a little venting of my frustration. I knew that there was a corporate bail-out and I knew it had something to do with the mortgage industry. The whole time I was asking myself, why should we give money to corporations. Don't they have enough already? It was fairly cold that day--on the sidewalk the protestors formed a semi-circle off to the side of Moscone Center barely enough to fill the sidewalk. That's when the chanting started. Natalie Hrize stepped up on the two crates she was using as stage and shouted "jail them don't bail them!" We were loud, we were charged but unfortunately it seemed like there just weren't enough of us. I think the problem is not enough people know exactly what happened with the corporate bail out plan. I recently attended a lecture by Dr. Jack Rasmus. He enlightened me to a few of the facts on what's happening on Wall Street and how the elites are furthering their war on the poor and working class of this nation. There isn't one direct cause of this economic downturn but there is an explanation behind it. It's pure and simple greed. The reason behind this rate decrease was that Greenspan was on his way out and didn't care and our fearless leader needed to win an election and keep the illusion that everything is fine. During this brief rate decrease between 2002 and 2004 mortgage companies wrote 4 trillion dollars in mortgages and half of them were bad loans that they would not have written under normal circumstances. This made their companies look so good on balance sheets that they would sell stocks in their companies around the world. Other countries were investing in our market because it looked really good even though there were bad predatory lenders giving people houses knowing that they wouldn't be able to make payments. Eventually the federal interest rate went back to normal and it came to light that the people they convinced to take these loans would not and could not pay them. There is a way to solve this problem. These companies don't need or deserve a Bail Out; we the people deserve a Bail Out. We need to reset all the rates to the way they were before 2002. This would alleviate the strain that a lot of people are feeling right now with high rates that these companies have imposed trying to save their own asses by screwing over everybody. That and instead of using tax money, the government needs to repatriate all those offshore tax shelters in the Caribbean and in Europe that these CEOs and investors have hid their stolen money at. Force these cowards to bail themselves out instead of profiting off of conning honest workers. |